End-to-End Platform for Digital Securities Issuance, Management and Trading

DigiShares – Leading provider of real world asset tokenization solutions.

Real Estate and Real World Asset Tokenization

The market-leading tokenization platform, deployed in 40+ countries, with a large number of configuration options, open APIs for integration into legacy systems, highly customizable user interfaces, and direct integration with RealEstate.Exchange.

Tokenize your properties, development projects, funds, companies, and assets to fund-raise, create liquidity for your shareholders, and significantly reduce cost by automating back office functions.

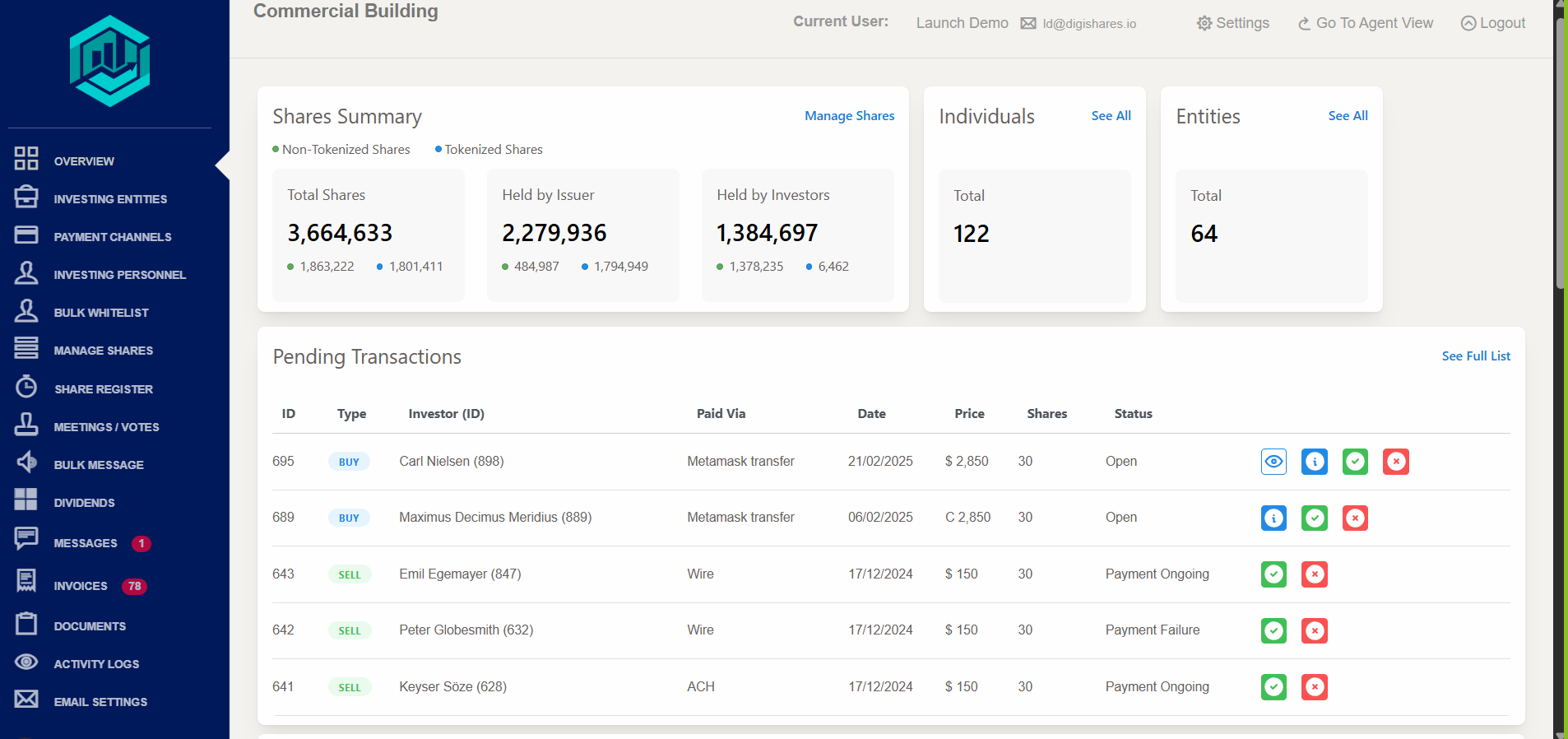

Issuer Dashboard

- Share Cap Table Management

- Automation of Compliance & Governance Processes via Smart Contracts

- Payment of Dividends (Crypto or Fiat)

- Shareholder Meetings and Voting System

- Fractionalization of Asset Ownership

- Asset Tokenization Engine

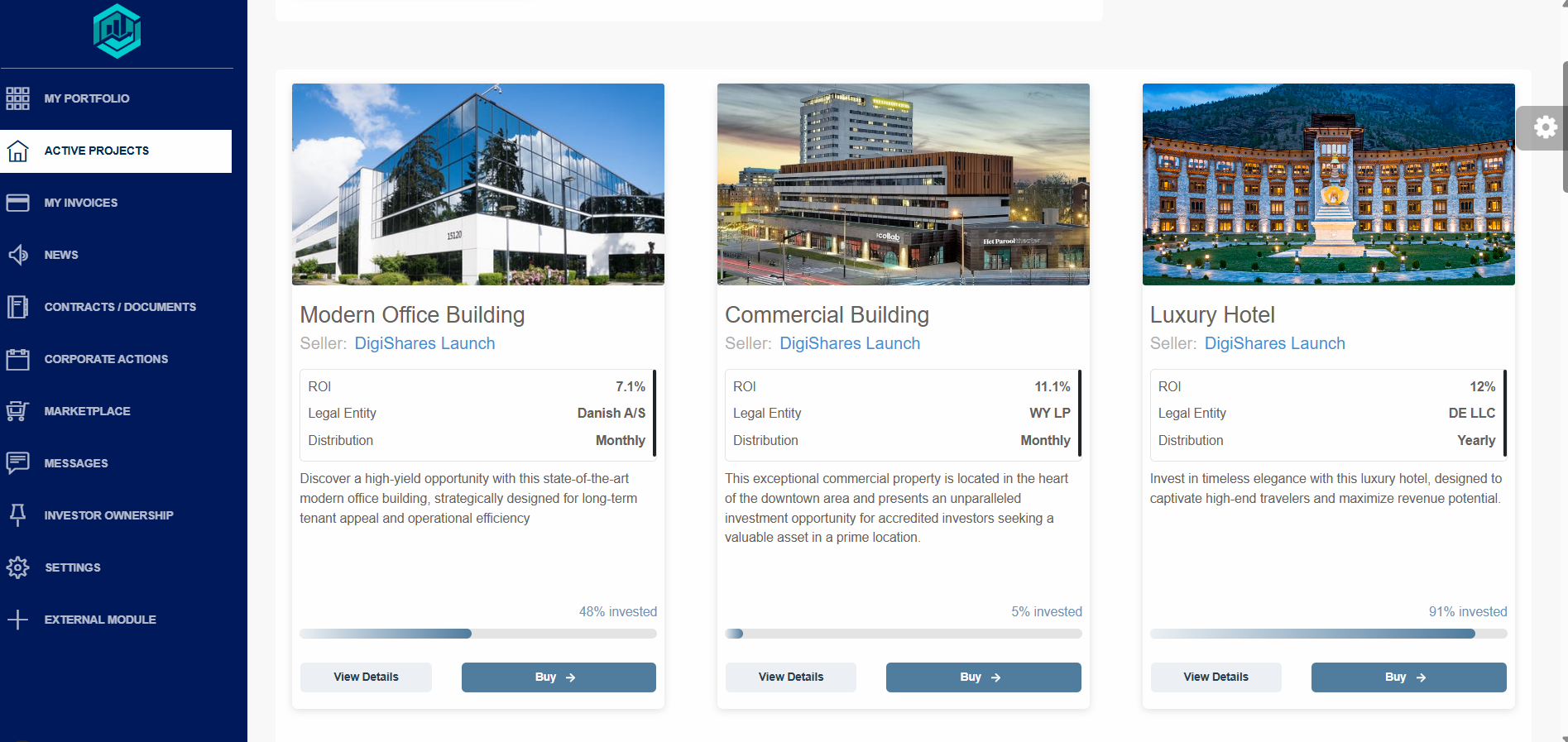

Investor Dashboard

- KYC / AML / Accreditation Check

- E-signature

- Custodial or Self-custodial Wallet Connections

- Share Purchases (Crypto or Fiat)

- Status of Portfolio & ROI

- Investor Forum

- Peer-to-peer Trading Module

Asset Tokenization, Investor Management and Trading Infrastructure. All in one platform.

The leading platform for blockchain-based investments in real estate, private equity, infrastructure, commodities, and more.

Optimize and digitize back office processes

Broaden your investor base

Provide more liquidity to your investors

DigiShares Platform Functionalities and Integrations

- Deal Presentation Page

- Share Classes and Rights

- Distributions

- Legal Document Library

- Fractionalization of Asset Ownership

- Homepage Integration

- Share Cap Table Management

- E-signature

- KYC / AML / Accreditation Check

- Share Purchases

- Investor Communication

- Shareholder Meetings and Votes

- Peer-to-Peer Trading Module

Compliance is incredibly Important to us

Beyond ensuring you understand how tokenization brings value and how it can be applied, we

believe in supporting and enabling compliance across the entire RWA tokenization market.

Primary Issuance

We provide a white-label tokenization platform that offers numerous functions for primary issuance and corporate actions. We have developed the system with compliance ‘baked in’ and underpinned by it. We require clients to collaborate with local legal partners to ensure compliance.

Secondary Trading

Tokens can be traded on DigiShares using a bulletin board that may require a license. Additionally, your assets can be listed on RealEstate.Exchange, a highly regulated and licensed exchange. We collaborate with leading legal and regulatory firms to ensure compliance with the regulators.

Explore Our Work

Upcoming Events

Frequently Asked Questions

What is the DigiShares tokenization platform?

DigiShares provides an end-to-end tokenization platform to manage the lifecycle of tokens and investors. It handles all aspects such as KYC, e-signing, minting, legal compliance, share cap table, distributions, fiat and crypto payment integration, corporate actions, trading, etc. In addition, it is highly flexible and customizable. It supports many configuration options and the entire user experience can be customized. It can be used “as is” for a fast launch or heavily customized for specialized requirements.

The DigiShares platform integrates smoothly with RealEstate.Exchange and other exchanges.

For further information, see a demo video here and follow it up with a Product Q&A which can be scheduled here.

Why and when should I use the DigiShares platform?

As an asset owner, real estate developer, broker dealer, fund manager, or similar, you should use the platform for the following reasons:

To digitize and automate subscription, trading, distributions, and several other administrative processes in order to achieve cost reduction, efficiency, transparency, and higher quality. The DigiShares platform serves as the web3 evolution of legacy investment management systems.

To fractionalize your assets in order to increase investor reach, by providing access for smaller investors and foreign investors. This can help with fundraising as more people can participate. It also contributes to the democratization of private assets.

To make your assets more liquid and tradeable in order to attract more investors and increase the value of your assets.

Be prepared for the future when it becomes possible to use your assets as collateral for highly efficient and competitive DeFi lending.

There are many different ways to benefit from tokenization from basic process optimization and becoming future proof as well as full embracing of fractionalization and liquidity. Contact us here to learn more.

Can you use the DigiShares platform off-chain without tokenization?

Yes, you can. If your users are mainly off-chain and inexperienced with wallets or if you are in a jurisdiction where crypto is banned or restricted, the DigiShares platform can be used off-chain either with all tokens kept internally in a master wallet or entirely without tokens. Users will then have accounts on the platform where they can check their portfolio but they will not be able to withdraw. Contact us here to learn more.

What are the configuration options of the DigiShares platform?

These are extended all the time but for the moment we support 90+ wallets through WalletConnect, KYC through SumSub and BlockPass, e-signing through DocuSign and Dropbox Sign, as well as fiat through Stripe, Dwolla, Payout.one and Gcash.

Which chains are currently supported by the DigiShares platform?

Is a license needed to use the DigiShares platform?

Generally not but it depends on your jurisdiction and whether you are tokenizing your own assets or third-party assets. We have clients in 40+ countries and more than 80 legal partners across the world. It is our top priority to ensure compliance for our clients. Our legal counsel stands ready to provide guidance on this and other topics. Contact us here to get a free call.

Which user dashboards are provided by the DigiShares platform?

Three dashboards are provided:

Platform administrator: the overall administrator managing the configuration and operations of the entire platform across projects.

Project administrator: the administrator of individual projects (or assets or deals). This person controls project descriptions and configuration.

User: the individual end-user’s dashboard to view portfolio, performance, etc. and invest in new deals.

How is DigiShares related to RealEstate.Exchange?

REX is a subsidiary and separate brand to DigiShares. REX is open for listing of tokenized real estate assets from other platforms, not just DigiShares. Initially we support only projects tokenized according to the ERC-1404 protocol but this will expand. See more here.

How much does it cost to use the DigiShares platform?

Our pricing model is based on predictable and competitive flat fees for onboarding and monthly payments. We don’t charge any performance or success fees and we don’t charge any transaction fees. It is easy to build your business model on top of DigiShares. View ou pricing here.