…

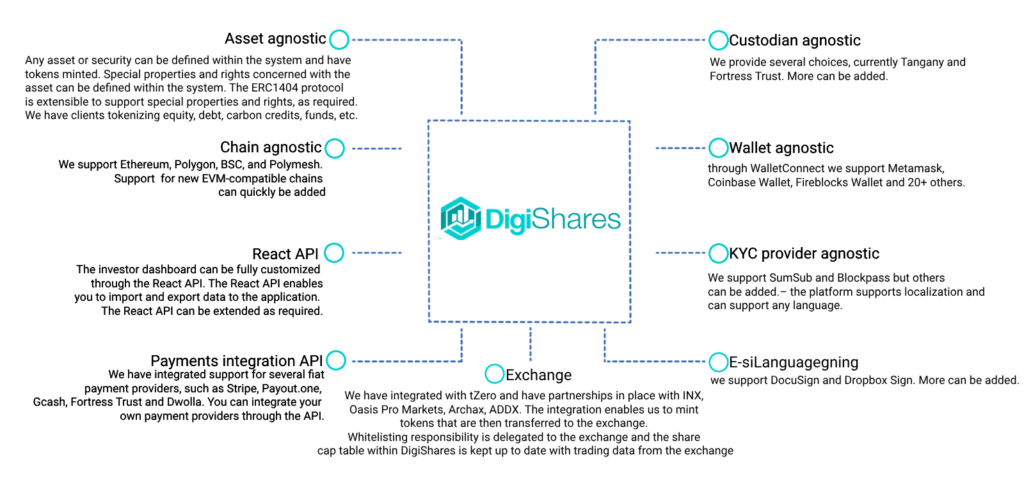

Technology Overview

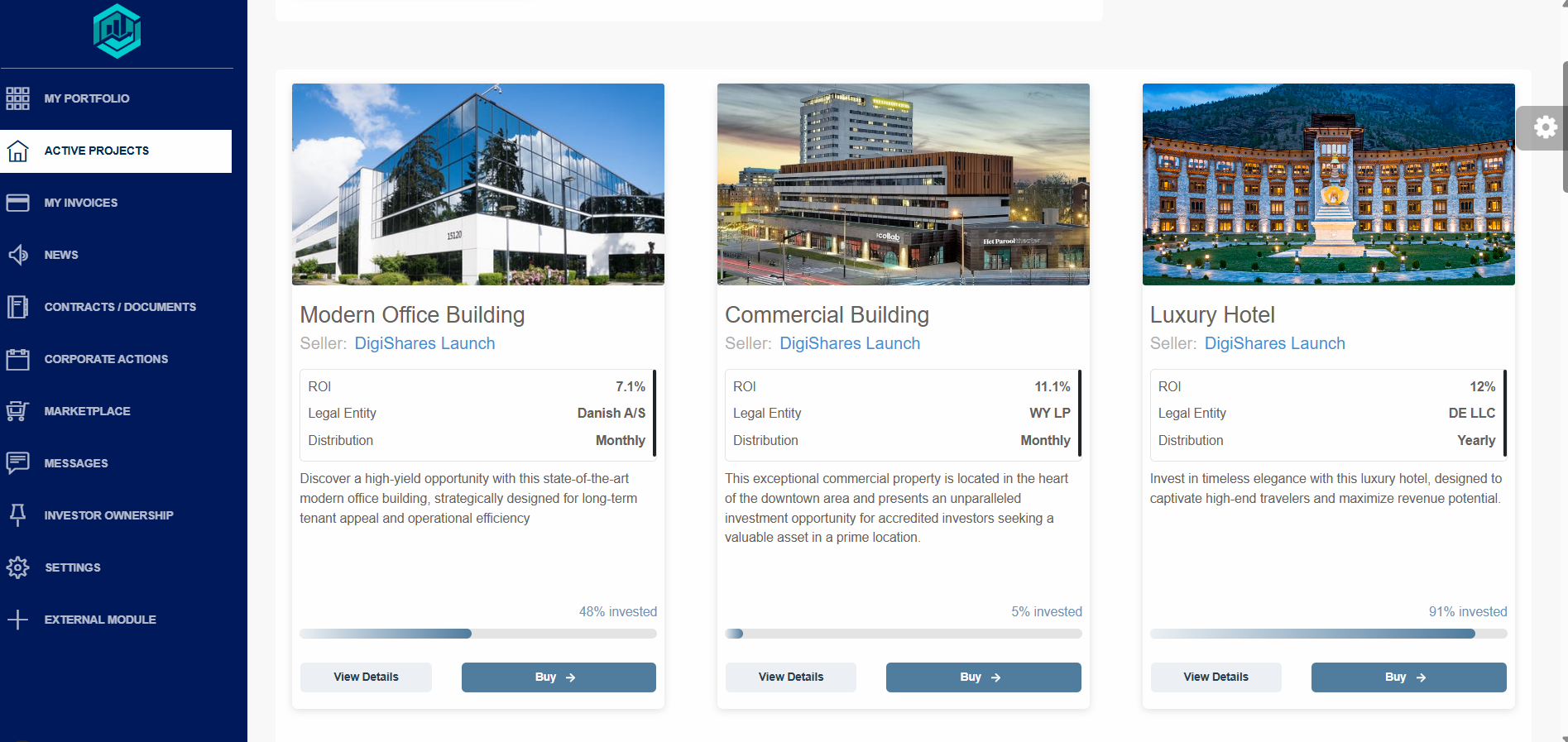

DigiShares is the market-leading provider of solutions for tokenization of real estate assets

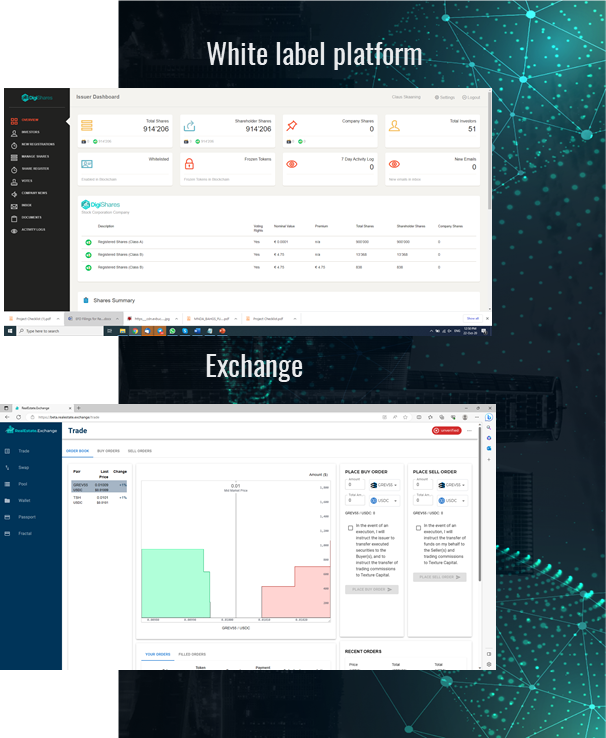

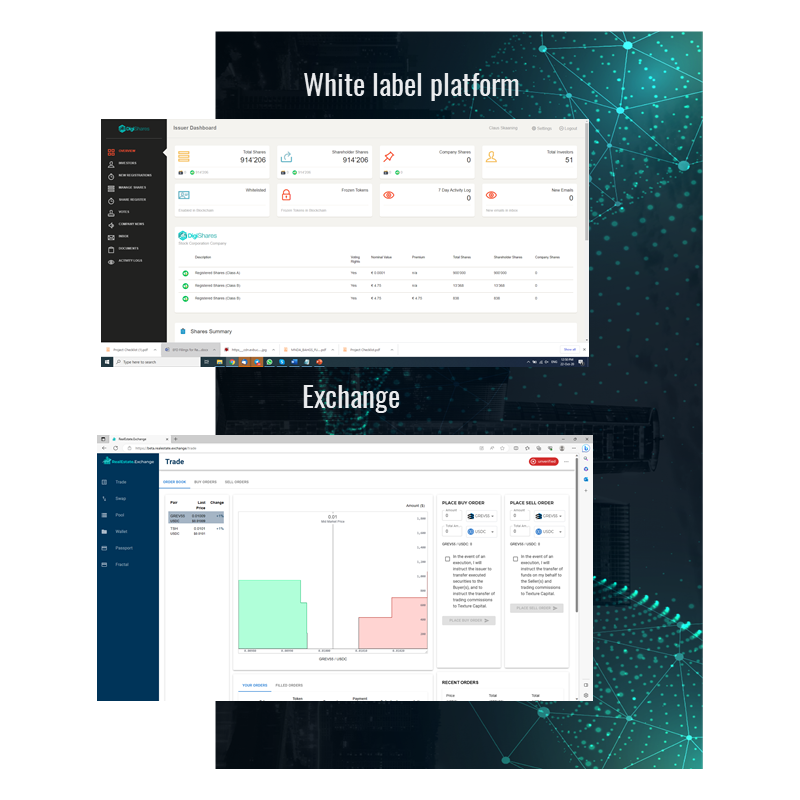

DigiShares gives asset managers full control over the fundraising process, ongoing corporate management, and trading of real estate and other assets, through an end-to-end white label solution

DigiShares is highly customizable and configurable with open APIs. We integrate with many KYC providers, payment providers, exchanges and custodians

Network of 80+ legal firms globally to ensure full compliance of the tokenization process

DigiShares launched the world’s first exchange for tokenized real estate assets:

RealEstate.Exchange in Q1 2025

DIGISHARES

REALESTATE.EXCHANGE (REX)

ISSUANCE, CORPORATE MGMT AND INTERNAL TRADING

- Investor registration and verification (KYC / AML)

- Token purchase with crypto and fiat

- Electronic document workflow and signatures

- Share cap table over multiple share classes

- Dividends and interest payout in crypto and fiat

- Internal bulletin board marketplace with atomic swap

- Trade tokenized real estate assets

- Atomic swaps between self-custodied wallets

- Access for retail and accredited investors

- US (Q1 2025), SA (Q2 2025), UAE (Q4 2025), Europe (Q2 2026)

- Order book, AMM/LP with Balancer

- BRICK token

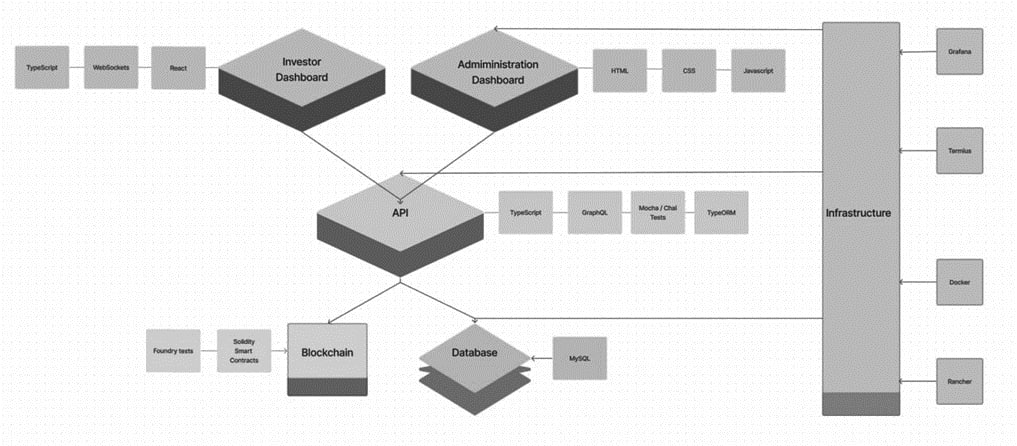

DigiShares Architecture

- At the basic level the platform is split into three parts

○Administration Side – backend which houses the logic of the platform

○API Side – exposes the functionality of the platform

○Investor Facing UI – provided for clients who do not have the capabilities to develop their own interface

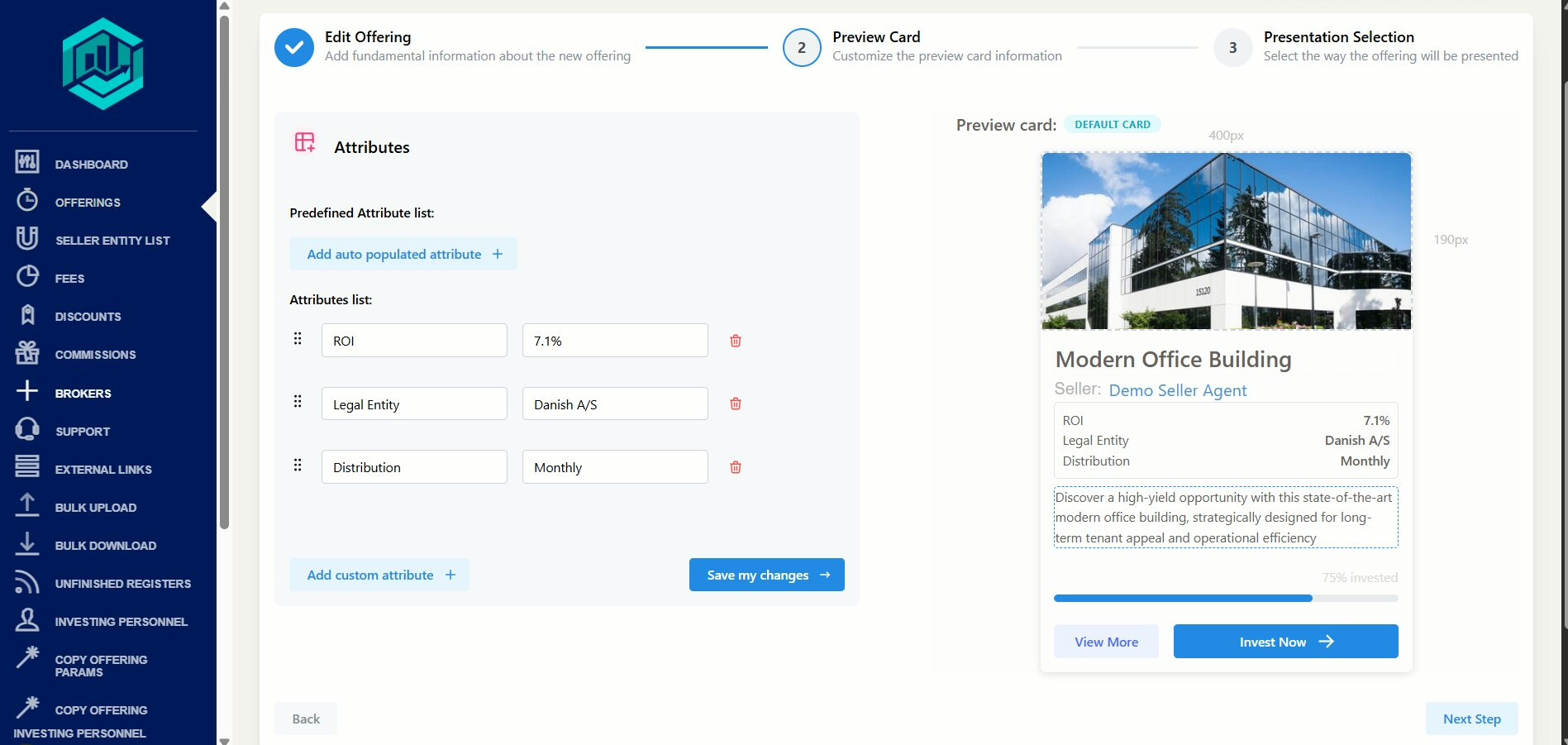

Solution Design

DigiShares provides a flexible, customizable, integratable, chain-agnostic, asset-agnostic white label platform for issuance and management of tokenized securities.

The DigiShares platform is divided into several layers:

1.User applications / interfaces

2.Dashboards (investor, administration)

3.API

4.Database (MySQL)

5.Infrastructure (Grafana, Termius, Docker, Rancher)

6.Blockchain

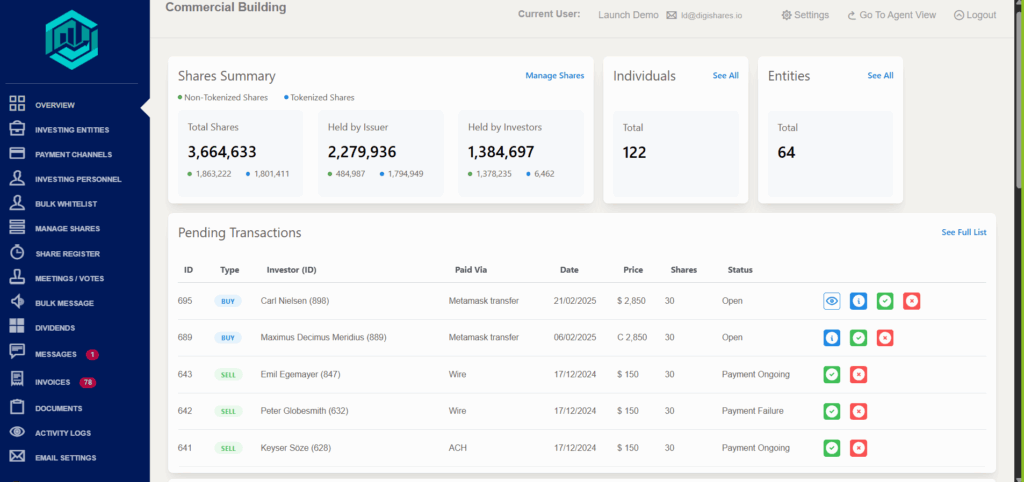

In terms of functionality, the platform is divided into three sections:

1)Issuance: defining of SPV, minting of tokens, KYC, e-signing, fiat and crypto payment workflows, investor dashboard, etc.

2)Compliance: share cap table, shareholder meetings, votes, forceful moving of tokens, etc.

3)Trading: bulletin board trading with atomic swap smart contract settlement and integration to exchanges

The DigiShares platform does not include:

∙Exchange – we include bulletin board functions but not a full exchange (see REX: RealEstate.Exchange)

∙Custody – we integrate with custody partners such as Tangany and Fortress Trust

∙Payment services – we use PSPs

∙KYC verification – we use third parties for this

∙Wallet infrastructure – we use third parties for this

API

The investor and administrator dashboards are separate user interfaces that connect with the API server. This layer has been designed using the following technologies:

-Node JS, GraphQL on the server side

-React (client side)

-HTML

-Javascript

We can customize the following user interface elements of the investor dashboard:

1.Customized KYC screens / steps

2.Custom Modules / Functionalities for investor dashboards

3.SSO (Single Sign On) or integration with client’s website (Cognito)

4.Integration of investor dashboard functionalities in client’s website

The API server exposes all the investor dashboard functionalities through secure APIs. This means that our clients can integrate the investor functionalities directly in their websites.

The client can develop their own modules on top of the API and the API can easily be extended on request

Flexibility & Customization

Third Party Suppliers

Payment service providers (through payments API layer):

Dwolla

Custody

WalletConnect

E-signing

KYC/Accreditation:

ISSUANCE, CORPORATE MGMT AND INTERNAL TRADING

- Investor registration and verification (KYC / AML)

- Token purchase with crypto and fiat

- Electronic document workflow and signatures

- Share cap table over multiple share classes

- Dividends and interest payout in crypto and fiat

- Internal bulletin board marketplace with atomic swap

- Trade tokenized real estate assets

- Atomic swaps between self-custodied wallets

- Access for retail and accredited investors

- US (Q1 2025), SA (Q2 2025), UAE (Q4 2025), Europe (Q2 2026)

- Order book, AMM/LP with Balancer

- BRICK token