This document will describe in detail how and why you should tokenize real assets and the DigiShares approach for this.

Contents:

(1) Real asset Tokenization – Why?

(2) The DigiShares Platform

(3) Real Asset Tokenization Processes

Many real assets have been tokenized until now, including real estate, mining operations, renewables projects, beverage distilleries, sports royalties, infrastructure, expensive objects of art, etc., etc.

1.Real Asset Tokenization – Why?

At the time of writing, the financial industry is seeing a very significant trend in the growth of tokenization projects and tokenization solution and services providers. DigiShares provides a primary issuance platform that supports ongoing corporate management of the real asset, as well as trading via the built-in OTC marketplace.

Other companies provide secondary trading exchanges for security tokens, custody solutions, legal services, etc. Many different pieces of the security token puzzle are now falling into place to form a more efficient, transparent, and secure blockchain-based infrastructure for securities transfer, settlement and trading.

Real assets including real estate is the biggest single asset class where tokenization can provide value – more than $200 trillion in total assets. Real assets share the value proposition of the overall securities market. We view some of the biggest benefits to real asset tokenization to be the ability to reduce ticket sizes by several orders of magnitude (from USD 100,000 to USD 1,000). This is made possible by the extreme automation of issuance and post-issuance processes, and it will dramatically increase the group of investors able to invest in a given fund. Another significant benefit is the new liquidity of real assets by making them tradeable. This will increase the amount of money available to invest in real assets, and on the other hand, will make the asset class more interesting for investors.

Real assets have some properties that lend themselves nicely to STOs – such as being relatively secure investments, requiring significant investment sums, being relatively easily comparable and quantifiable, as well as being notoriously illiquid investments. Real assets will as such benefit from the “standard” blockchain value properties such as: (1) the ability to automate and reduce the cost of issuance, transfer, settlement and trading processes, (2) the ability to automate and reduce the cost of governance processes such as cross-border transfers, cross-investor-type trading, lock-up periods, caps on investor counts, etc., (3) the subsequent increased ability to engage foreign investors and larger numbers of (smaller) investors thereby increasing the pool of investors for any given project, (4) the ability to reduce or remove different types of intermediaries such as CSDs, transfer agencies, broker-dealers, etc. due to the blockchain trust layer thereby increasing efficiency and reducing cost further, (5) the increased ability to attract investors due to the previously mentioned benefits (additional liquidity), and (6) the ability to significantly reduce ticket size of investors by an order of magnitude to cater for retail investors due to the automation of processes.

We will therefore see that good projects can raise capital easier, faster and at a reduced cost, investors will enjoy increased liquidity on their investments, good projects will get a liquidity premium, and investors will globally get access to previously inaccessible types of investments.

For some years now crowd-funding platforms have offered access to invest and trade “digitized” various real assets (primarily real estate). Why is tokenization better? For two main reasons. The “old” crowd-funding platforms are siloed and not interoperable globally. The global tokenization industry will use the same standards such that tokenization platforms on different continents will be inter-operable. This means that real assets issued by DigiShares will be tradeable on exchanges in the US, Europe and Asia. It also means that tokens issued by DigiShares can be kept in safe custody by most security token custodians globally. Finally, it means that no investors or issuers will be locked into a single vendor’s ecosystem but will be able to transfer their tokens for trading or custody to any other vendor globally (only limited by regulatory restrictions). The other reason is that blockchain technology is a much more modern, secure and efficient method for implementing securities transfer, settlement and trading compared to proprietary digitization of securities.

Further reading:

DigiShares real estate blog articles.

DigiShares CEO presentation on real estate tokenization.

Tokenized Securities & Commercial Real Estate.

2.The DigiShares Platform

DigiShares provides a white-label platform for digitizing securities (shares, bonds, etc.), issuing these in order to raise funds for a project, longer-term management of a group of tokenized investors, and an OTC marketplace for trading of these. The DigiShares platform is “white-label” meaning that it is exclusively sold to partners who offer the platform under their own brand-name.

The DigiShares platform can be used in connection with fund-raising but it can also be used in connection with the tokenization of existing real estate funds, in order to create more liquidity among existing investors and make it easier to on-board new investors.

The DigiShares platform provides a lot of functionality, however, the most important to mention is that it supports three main processes: (1) the issuance process where tokenized securities are issued in order to fund-raise for the project, (2) the longer term management of a group of investors who are holding tokens to document their ownership of securities within the project, and (3) the trading of tokens via the built-in OTC marketplace.

For the issuance process we support a customized on-boarding process where KYC and AML options can be adjusted to the specific jurisdiction of issuer and investors.

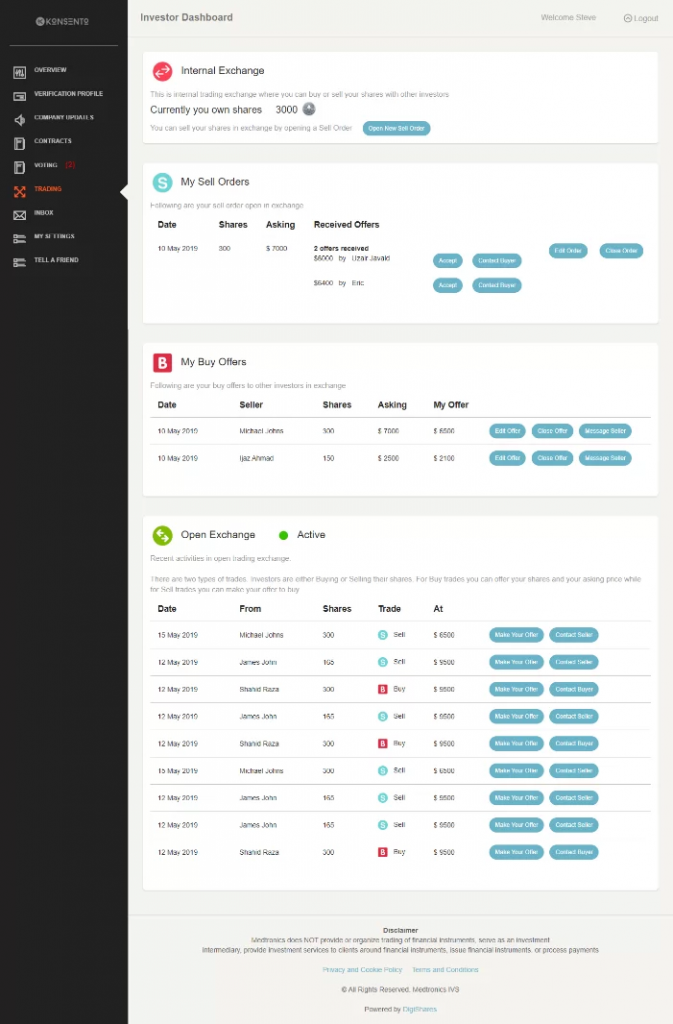

The investor has his own dashboard where he can view his token holdings, communicate with the issuer, vote on relevant issues such as how to renovate a building, purchase more tokens, etc. The issuer has a dashboard where he can verify investor provided KYC documentation and approve investors to participate in the STO. Once the investor is approved, he can buy tokens with various payment options. The solution has an e-signature module such that the contract workflow can be automated and digitized as much as possible. The KYC verification process can be handled internally or outsourced to a third party.

For the management of token holders over the longer term, many functions are provided to ensure communication with investors, to conduct token holder (shareholder) meetings, to conduct votes, pay out dividends (possibly with stablecoins), maintain the share cap table (shareholder register), etc. In addition, the solution supports various corporate actions giving the administrator (normally a top executive of the issuer) the right to forcefully transfer tokens from one investor to another, or back to the company – and to reissue tokens in case an investor lost access to them.

The platform also provides an internal OTC-like (Over The Counter) trading exchange. This means that existing investors within a project can trade tokens with each other. They can issue buy and sell orders and can match these on their own in a manual manner. It is also possible for new investors to be white-listed and invited into the exchange such that they can buy tokens from the old investors. This function provides increased liquidity within a single project and will provide an extra value for investors.

The platform is “multi-STO” meaning that it can handle multiple STOs in parallel, at the same time. Each STO can have its own URL for investor on-boarding and will have its own graphical content, presentation and content. This makes it possible for the real estate developer to have several ongoing real estate projects being active simultaneously in the platform.

The platform is increasingly integrated with payment providers, custodians and third-party KYC / AML providers.

The DigiShares platform is highly suitable for real asset tokenization as it allows the issuer to manage and automate many of the processes related to fund-raising and ongoing fund management. The platform works with different security token protocols and we prefer to work with those that are open and do not enforce any kind of vendor lock-in.

While DigiShares is “bullish” on real asset tokenization, we do realize and acknowledge that not all investors understand and accept blockchain and indeed are prepared to hold a security token in a crypto wallet. For these investors we cater in two ways, one is by working with custodians who can hold the tokens for these investors (at a cost), the second is by enabling the platform to also support non-tokenized investors, that is, investors that do not receive tokens to represent their ownership but rather are registered within the platform as normal/traditional investors.

The DigiShares platform is constantly being updated in order to reflect changing and evolving market needs and the agile approach of DigiShares help our clients to stay up to date and relevant.

3.Real Asset Tokenization Processes

So how does one go about tokenizing a property? Either to raise funds for a new development project, or to sell an existing property?

When a client engages DigiShares in this process, we also involve our legal partner in order to help with legal matters in relation to the issuance. As such, two processes start and run in parallel, the legal and the technical processes. (It is also possible to work with the client’s internal legal department or legal partner if they are sufficiently knowledgeable in STO regulations).

For any project one of the initial steps will be to create a project plan / roadmap for both the legal and technical work.

The legal process:

1) Deciding on jurisdiction for the projects. Tokenization projects fall under standard securities regulation and are as such indirectly supported in many countries. However, many countries do not support the full digitization of securities such as shares and bonds due to requirements for notarized transfers, paper-based ownership certificates, etc. Other countries are unclear on regulations so far. DigiShares and our legal partners keep track of regulatory developments and can at any time recommend best options, optimizing cost and regulatory complexity, while at the same time catering to investors in one of the three main regions (USA, Europe and Asia). We will be able to provide a recommendation for countries that support tokenized securities – or in case these are not supported, simplified types of securities such as profit-sharing rights or debentures that may more easily be tokenized.

2) Once a jurisdiction has been selected, the legal unit (the SPV = Special Purpose Vehicle) should be created and a bank account obtained.

3) Designing the fund-raise itself, based on amount to be raised and type of investors that are targeted. Together with our legal partners we can give recommendations on this. In the US, if the amount is above 1 M USD (as is almost always the case), it is relatively straightforward to conduct an STO under the reg D exemption where only accredited investors can be targeted. In Europe, there are more choices. If less than 5-8 M euro is raised, it is possible to make a public offering towards retail investors in many European countries. If the amount is above 5-8 M euro, it is normally necessary to get a prospectus approved which is a more costly and time-consuming process. For more insight, please click here.

4) Design the security to be tokenized. For real estate this is typically a share in the company owning and administrating the property, but it can also be a tokenized loan, profit-sharing right, dividend-distribution right, etc.

5) Designing the KYC (Know Your Customer) process for on-boarding investors. Together with the legal advisor, it is necessary to determine what information must be provided by investors in order to document their ID and address, for retail and accredited investors, and for consumer and business entities. Verifying the ultimate beneficial owner for a company may be quite complicated and time-consuming, so it is best to require of the investor to provide all relevant information when registering.

6) Reviewing and determining what kind of reports and updates have to be made to public transfer agencies, CSDs, etc. These can be generated as custom reports from the platform.

7) Depending on the type of raise, different types of legal documents need to be produced, such as either a private placement memorandum, a public offering memorandum, a regulation D filing form, a US or EU prospectus, etc.

The technical process:

1) Customizing the KYC process based on the input from the legal process.

2) Customizing the contract workflow deciding which contracts need to be used for the signing up of investors and subsequent token purchase, such as subscription forms, purchase receipts, shareholder agreements, etc. The goal is to automate the contract workflow as much as possible.

3) Customizing the content and information available to attractively present the property, including photos, financials, etc.

4) Customizing payment options including credit card payment, bank transfer and crypto payment. Again, the goal is full automation but this may require banking integration which can be time-consuming and expensive.

5) Customizing custody options – either with integrated custody partners or just by setting up agreements to custody investor tokens, paid and managed by either the issuer or the investors on their own.

6) Installing and customizing server software and training the issuer administrators in using the software platform.

7) Testing that everything is ready for the STO launch.

8) Pushing the “start” button and launching the STO.

9) A normal STO will typically last for 2-3 months.

In addition to the above workflows, there are also workflows relating to marketing and investor relations that DigiShares can also support. DigiShares is connected to both marketing agencies and investor relations services providers world-wide that are experienced in assisting with fund-raising for real asset projects.

For more information, please contact DigiShares at [email protected]